Kodehyve collaborates with KLEYR GRASSO to launch KYC and AML module

Kodehyve collaborates with law firm KLEYR GRASSO to launch advanced KYC/AML module & compliance platform for property developers.

Kodehyve

Kodehyve

ConTech kodehyve collaborates with leading Luxembourg law firm KLEYR GRASSO to launch advanced KYC and AML module and standalone compliance platform for property developers and stakeholders of the built ecosystem.

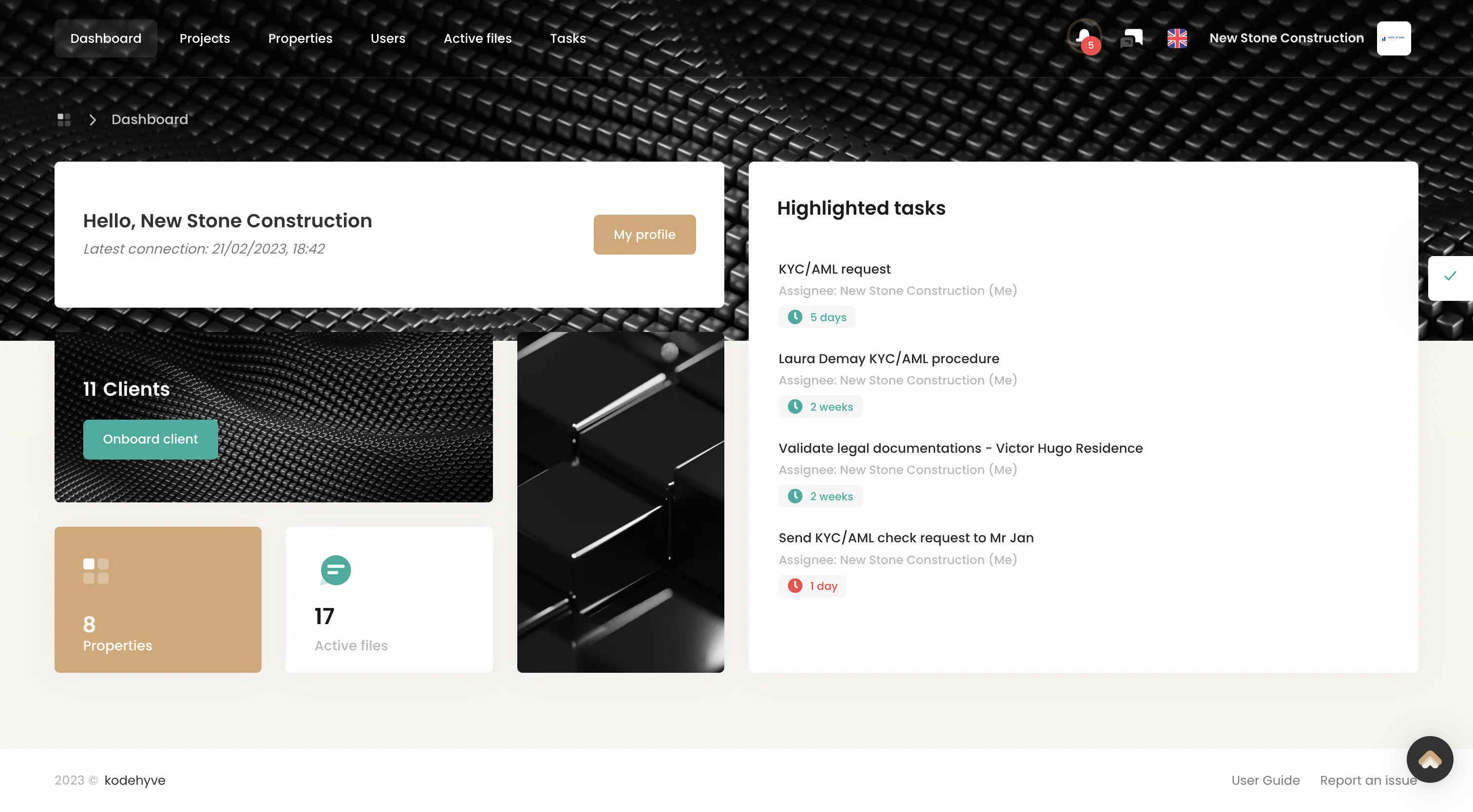

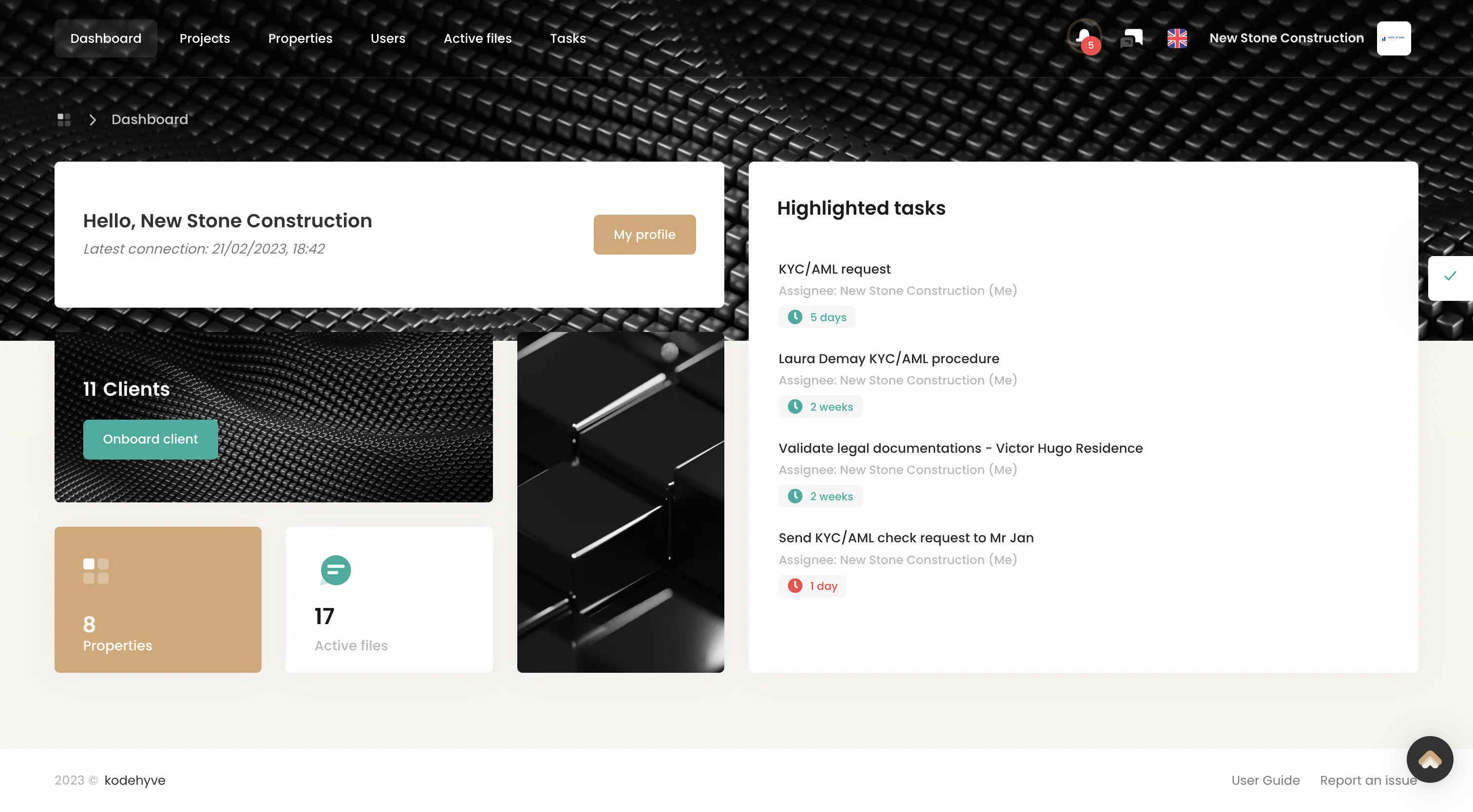

kodehyve, the ConTech venture helping stakeholders of the built industry to de-risk their activities, unleash efficient collaboration, enhance productivity and transparency, as well as boost profitability, called upon services of KLEYR GRASSO, the Luxembourg independent law firm, to launch a Know Your Customer (KYC), Anti-Money Laundering (AML), Beneficial Owner (BO) and Counter-Terrorist Financing (CTF) compliance module, dedicated to smoothen and automate the compliance processes for property developers and all parties involved in real estate transactions.

The module has been developed in response to changes of the law of 12 November 2004 against money laundering and terrorism financing (AML Law) in Luxembourg in 2020 bringing property developers within its scope, including them in the definition of professionals subject to the AML Law. This cutting-edge solution will provide property developers with a seamless and efficient way to comply with the new professional obligations, while also helping to prevent money laundering and other financial crimes.

With this new module, kodehyve continues its commitment to providing the most advanced and secure real estate technologies in the market, helping stakeholders of the built industry de-risk their activities.

Context and stakes for property developers

Following the changes of the AML Law, property developers (also when acting as intermediaries) and other real estate players - are now required to perform a risk assessment and a customer’s due diligence. They are also required to put into place AML/CTF internal policies and procedures. This includes enhancing their customer due diligence processes, verifying, among others, the identity of persons (including beneficial owners) with whom they start or are in a business relationship, understand the nature of their business, their ownership and the envisaged transactions, maintaining records of transactions and customer due diligence for a specified period of time, and to report suspicious transactions to the authorities.

Additionally, they are required to ensure that their risk management systems are in place and comply with their new professional obligations. These steps are essential for compliance with the AML/CTF legal framework in Luxembourg and to prevent money laundering and terrorist financing activities.

The solution

The evolving nature of compliance regulations and requirements in AML/CFT can be difficult and time consuming to keep up with. With this new module, real estate players will have a comprehensive working tool at their disposal to help them to comply with their new professional obligations taking into account the latest AML/CFT regulations and requirements.

The launch of the new module aims at assisting real estate professionals in performing due diligence on customers and beneficial owners. The powerful solution effectively alleviates compliance struggles for property developers and all their related stakeholders by providing them with a comprehensive and reliable platform to perform due diligence on potential clients and investors. The module is specifically designed to simplify and automate the often complex, manual and time-consuming process of gathering vast amounts of heterogeneous data, making it easier for property developers to process the information received and giving them more time to perform their risk analysis and other truly value-adding tasks.

The solution will be available to real estate professionals in kodehyve OS, kodehyve’s flagship solution, as well as in a standalone compliance application, kodehyve comply. Software Development Kits (SDKs) are available for organisations wishing to integrate the module in their existing solutions. Beyond real estate players, the technology is also available for kodehyve legal customers such as notaries and lawyers so as to automate their due diligence processes.

"We are excited to join forces with KLEYR GRASSO, our expert and reliable legal partner, to launch such a state-of-the-art compliance module. Compliance with the new regulations is a daunting task for property developers which is why our solution aims to substantially simplify their compliance process. We are convinced that this collaboration will bring significant benefits to property developers by automating compliance procedures and derisking their businesses by avoiding non-compliance and associated penalties. We believe that our solution will have a positive impact on the real estate industry and will contribute to increasing transparency across the ecosystem." added Felix Hemmerling, CEO at kodehyve.